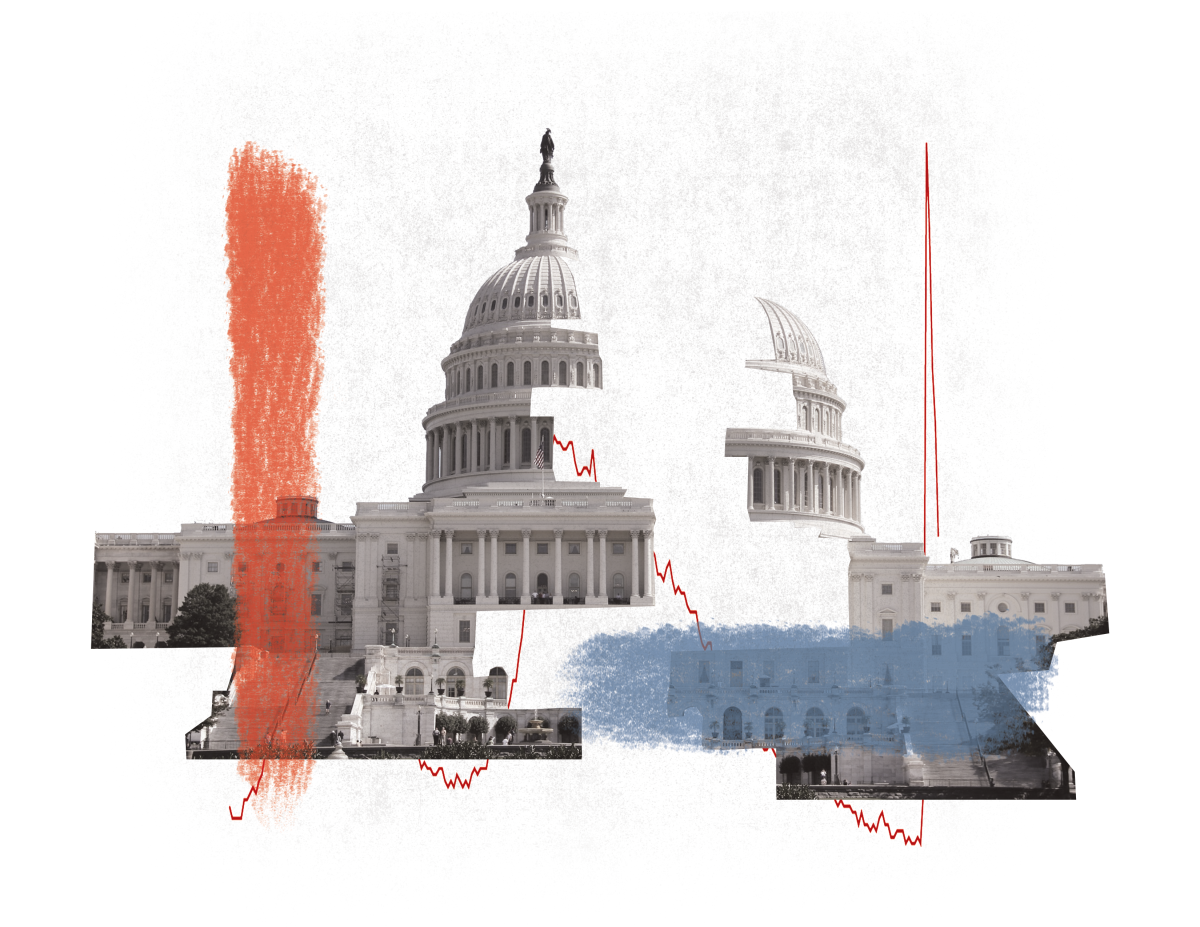

In a move that shocked many people and media outlets, CEO of Turing Pharmaceuticals Martin Shkreli increased the price of Daraprim from $13.50 to $750.

Daraprim is a prescription medication that is used to treat a variety or parasitic infections. Notably, it is used to treat toxoplasmosis in people with HIV. Toxoplasmosis is caused by Toxoplasma gondii, one of the most common parasites in nature. Normal non-immunocompromised individuals do not generally get toxoplasmosis because the immune system is capable of effectively fighting the parasite. However, immunocompromised individuals, such as those with HIV, are at greater risk for contracting the infection.

At this point, you may be thinking that Daraprim is a new drug that is going to revolutionize management of opportunistic infections in HIV patients. It is not. Daraprim is actually a 62 year-old drug that has been used for a long time to treat parasitic infections in immunocompromised individuals. It was first approved by the FDA in 1953, and it was sold for $1 by a drug company called GlaxoSmithKline. Rights to the drug were later sold to CorePharma, and CorePharma was acquired in 2010 by Impax Laboratories for $700 million. In August 2015, Turing Pharmaceuticals bought rights to the drug from Impax for $55 million. After the acquisition from Impax Laboratories, Mr. Shkreli announced that the price would be raised from $13.50 to $750. Since coming out with the news, Mr. Shkreli has taken a lot heat from media outlets as well as high profile individuals such as Hillary Clinton.

When asked why he would raise the price like that, Mr. Shkreli claimed that it was to make a profit. He further elaborated that at the price of $13.50, the Impax (the former owner of Daraprim) was not profitable. This claim raises a couple of red flags. I will give Mr. Shkreli the benefit of the doubt and accept that at $13.50, Daraprim was not profitable.

Red Flag 1: If Daraprim was not profitable at $13.50, why would Impax Laboratories not raise the price itself? What type of self-respecting, profit-seeking Pharmaceutical Company would continue to sell a drug that is not profitable?

Red Flag 2: The absolute price of the drug increased by $736.50. Does Turing Pharmaceuticals really need to raise the price by over 5000 percent to turn a profit? If that is true, then how much of a loss was Impax Laboratories selling Daraprim for? (The answer to the second question cycles back to Red Flag 1)

One possible reason that Turing Pharmaceuticals chose to raise the price of Daraprim is that the company wanted to distribute costs across more drugs. The art of cost-recouping is common in the pharmaceutical industry. The cost of a medication takes into account a variety of separate costs. When deciding on a price, the pharmaceutical company has to look at its operational costs and its desired profits. Let’s look at Daraprim as our example. At a cost of $750 dollars per pill, not all of it is profit. Part of the $750 dollars goes to manufacturing costs (making the pill), distribution costs (distributing the pill to various buyers), payroll (paying employees), paying bills (bills associated with operating a building), paying testing fees (fees paid to have the drug tested and approved), and paying for developmental costs. The last factor interests me the most. Pharmaceutical companies have to try out many formulas for drugs, and not every design will be a success. Through the drug testing process, if a drug fails a test at any point, a certain amount of money invested is lost. Drugs that make it to the market are priced in a way that takes into account the money lost through failed drugs. By raising the price of Daraprim, Turing Pharmaceuticals is able to distribute a variety of costs from other drug ventures.

Is this ethical? Is it right to inflate the fruits of success to offset the costs of failure? This is a tough question to answer, and I think that both sides have a valid point. Whether right or wrong, at this point, cost-recouping helps keep pharmaceutical companies afloat. Every failed attempt to produce a drug costs millions of dollars. This consequence of failure affects the way that pharmaceutical companies approach drug research. On one hand, the fear of failure may motivate pharmaceutical companies to be extra careful and cautious when funding drug research. On the other hand, the fear of failure may actually deter pharmaceutical companies from innovating because the costs can lead to huge financial issues. The latter is the reality for many pharmaceutical companies. This is the fact: If pharmaceutical companies cannot use the fruits of success to recoup the costs of failure, they will not innovate and try to produce better drugs because the costs of failure are financially crippling.

This is my take on the situation. I am not against drug companies recouping costs and seeking profits. As long as the pharmaceutical industry has an incentive to innovate, it will continue to produce newer and better drugs that can improve the quality of healthcare that the American people receive. When those companies are afraid to fail, that is when the quality of healthcare stagnates. With all that said, I am definitely against pharmaceutical companies inflating drug prices to a point where hospitals are unable to afford certain medicines and have to resort to providing alternative treatments (that have not yielded substantial results) to treat patients. The biggest hurdle for drug companies is to find the optimal balance between profitability and civic duty.