In recognition of Financial Aid Awareness Month, Student Financial Aid Services will be hosting 2 FAFSA workshops.

February has a couple of trademark characteristics. Usually the coldest month of the year, February is also well known for Black History Month and Valentine’s Day. But the 28 days also boast a lesser known celebration: Financial Aid Awareness Month.

The purpose of the month-long observance, according to the National Association of Financial Aid Administrators, is to “provide crucial information to students and families about access to federal, state, and institutional student aid.”

NJIT’s Office of Student Financial Aid Services (SFAS) is committed to that cause. Having already hosted three FAFSA workshops this month, the office is making a notable effort to improve their services, and be transparent, present, and accessible to NJIT students.

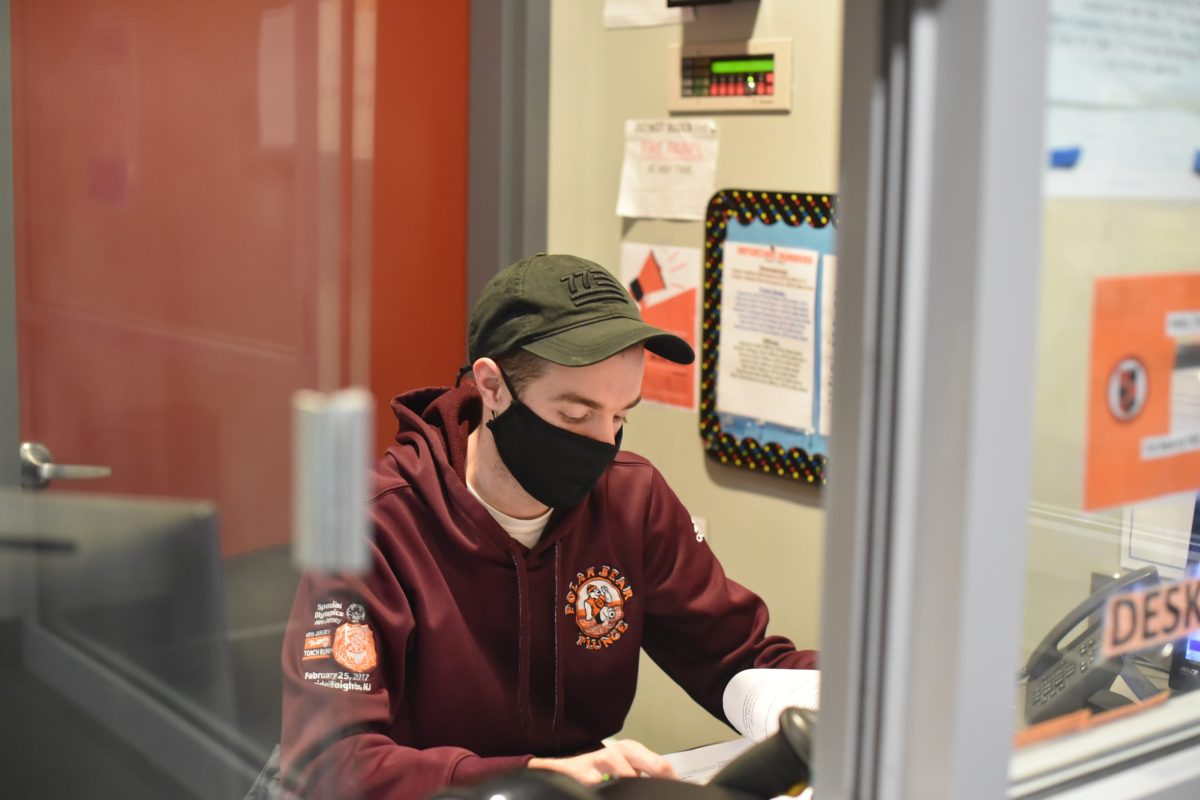

We spoke with Ivon Nunez, the Director of SFAS, to find out just how the office was endeavoring to reach that goal. “To that end, we purchased a cutting-edge software called CampusLogic Student Forms that will eliminate paperwork and streamlining the paperwork submission process,” he said. The software also offers text capabilities and a to-do list “to keep students focused and on track to completing their files”, a critical task thanks to document submission deadlines.

Ideally, the implantation of Student Forms will allow the SFAS staff to focus on providing students with other services offered by the office, such as student debt counseling, financial literacy services and assistance with student employment.

When asked if he was aware of these services, Sagar Solanki, a fourth-year mechanical engineering student, said, “No, I had no clue. I wish I’d found that out before my last semester.”

This sentiment gets to the core of Financial Aid Awareness Month: making students aware of the services and assistance available to them.

“We want our students to know that we don’t just simply process financial aid forms,” said Crystal Allen, Assistant Director of SFAS. “With student debt on the rise nationwide, we are committed to helping students make better-informed decisions about the investment that their making in their education.”