New Jersey passes legislature to assist student loan payback process

On April 25, Governor Phil Murphy signed into law Senate Bills 3149 and 3125 with bi-partisan support. These laws intend to help students who have obtained New Jersey State loans to pay them back should they have difficulty due to financial hardship.

The first law allows students to get their loan on a “probation” status if they have been unable to pay monthly installments after six months and thus, the loan goes into default. New negotiations can be made with the state and “If parties to a defaulted NJCLASS loan program loan demonstrate… an ability and willingness to repay the loan by making nine on-time monthly payments over the course of ten consecutive months pursuant to the settlement agreement, the loan shall be considered rehabilitated.” This gives borrowers a second chance to find employment and make reasonable payments. This probation status requires that the loan be renegotiated with the loan agency. This law does not include any kinds of assistance in federal direct student loans or any private loans such as those from Sallie Mae; exclusively NJCLASS and HESAA loans are discussed in these laws.

Edelin Aragon, a freshman Business and Information Systems major, was ineligible to obtain any public loans and cannot benefit from these repayment opportunities. “I feel like it should be open to all loans. At the end of the day, our college careers, we’re all going to be in debt.” She expressed concern about these loans and paying them back. With $16,000 or $30,000 for tuition and fees, along with an estimated room and board expense of $10,000, attending NJIT would cost anywhere from $26,000 to $40,000 a year without any scholarships or grants.

Loumy Volmaer, junior Human-Computer Interaction major, has acquired multiple public loans and thought it was great for this new legislation to be passed. “College is very expensive, you don’t really have a choice in taking loans. And you hope that, in the future, you will be able to pay them back.” Volmaer expressed that his major was chosen not just for learning about user-interface principles, but also because it has a lucrative future in the job market. “There’s no real guarantee you’re gonna [sic] get a job these days.”

The second law involves individuals who are experiencing financial hardship, which is legally defined as an individual whose parents do not claim them as a dependent on their tax returns and are in poverty, or if everyone whose name is legally responsible to payback a loan is unable to maintain a basic standard of living and still make loan payments. Bill S3125 states that “Under the Repayment Assistance Program, eligible borrowers shall pay a reduced monthly loan payment equal to 10 percent of the total of the aggregate household income of all of the parties to the loan that exceeds 150 percent of the federal poverty guidelines, with a minimum monthly payment of $5.”

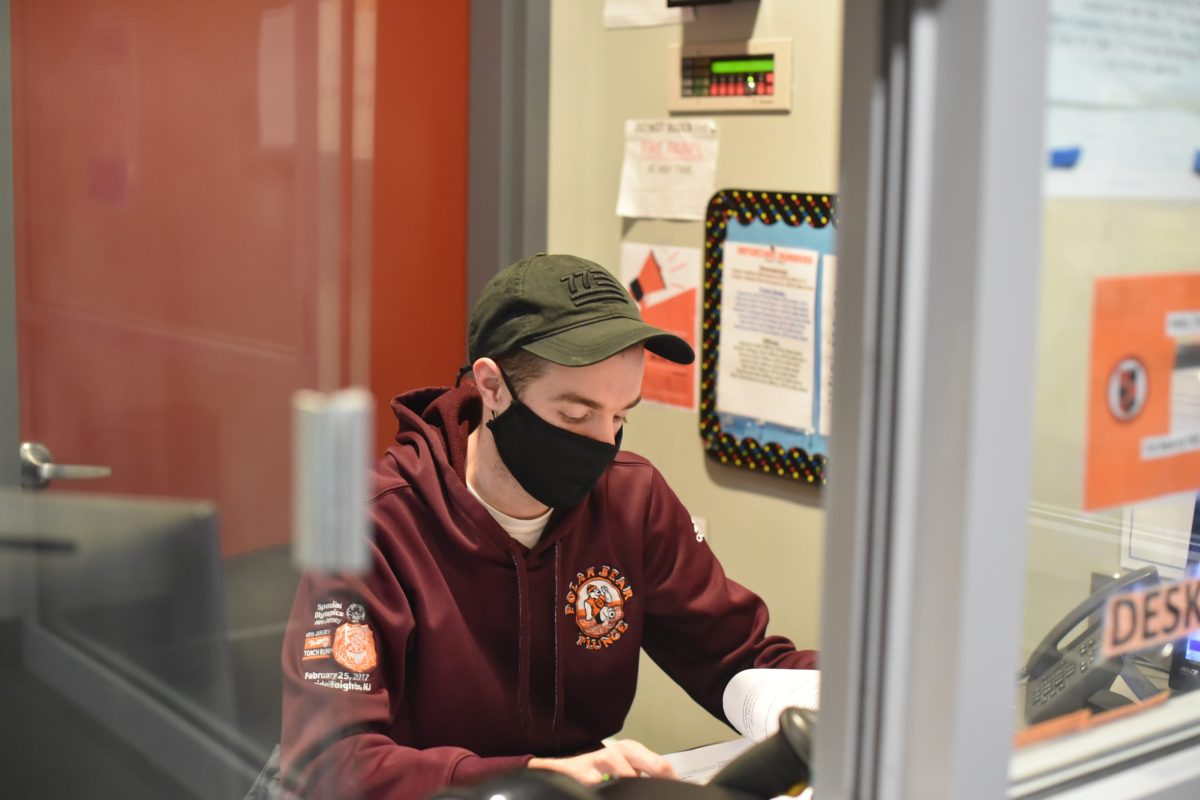

All students interviewed were unaware of the passage of these laws, save for Sagar Solanki, a graduating senior Mechanical Engineering major. “With the new bill that passed in hopes to help borrowers repay the debt, I think I’ll be able to breathe somewhat more easily now knowing that our government does have some good interest for the students, pun not intended. Although I don’t have a lot to payback in comparison to many of my classmates, I still stress over the thought of possibly not being able to afford the monthly dues of repaying my loans in the upcoming future. However with this new bill, I have a sense of relief given that the amount I’d have to pay back every month could be lower than my cellphone bill. “